Those who have neither customers nor relatives or friends who can help with financing, or who simply don't like working with banks, have it much easier today than before 2007. Entrepreneurs or founders can post their loan or credit requests on Internet platforms, following the example of the "eBay" auction platform, and hope that lenders will come forward. Also for those who need financing between 1.000 and 25.000 euros, this route can be a sensible solution.

What is still in its infancy in Germany has long since become established in the USA with prosper*com. However, registration there is only possible for US citizens. It is expected that money transactions via the Internet will continue to grow in Germany as well. The "zopa" platform is active in England, the USA, Japan and Italy, for example – we may hear about it in German-speaking countries as well. One thing is for sure: It is exciting to watch the further development – such a young industry with good prospects for the future will certainly still change. But the foundation stone has been laid, and many small companies and also small investors are benefiting from it.

What characterizes "person-to-person credit"?

More and more platforms are emerging where lenders and borrowers meet. If you are interested in this and are looking for a suitable environment for you on the Internet, you should consider the following criteria:

-there are many successfully completed projects?

-Will data protection be taken into account?

-Will the identity of borrowers and lenders be verified, for example by the Postident procedure?

-The creditworthiness of the borrowers is checked?

-The costs for the credit check are?

-How high is the commission for the platform operator, if a project comes about?

-Are there any further costs?

The criteria lead to the conclusion that "smava" – at least currently – is ahead of the pack. This is also confirmed by a test conducted by "Stiftung Finanztest" in November 2008. Therefore, we use "smava" as an example of how loans from private over the Internet work.

Mike Kösching is a self-employed master carpenter and would like to build and offer houses made of natural wood logs. However, since many customers cannot imagine what such a house would look like, a show house had to be built. Mike Kösching wanted to handle the corresponding financing via "smava" – shortly after the platform was opened for self-employed persons.

Why did you decide not to use a bank?

For the model house, the logs had to be purchased. But because these can not be stored for months until the bank

processed a loan application, it had to go faster. My business advisor, in whom I have great trust, gave me the tip to try "smava", so I did not even check with a bank. In addition, you can "smava" repay early at any time without having to accept deductions. With a bank it is not so simple. On the platform I then read through all the information and the current offers at my leisure. After that my last doubts about the concept of "borrowing money on the Internet" were dispelled.

How well and quickly the whole thing went?

There were three weeks between the application and the payment of the money. It could have been faster, but I had to collect my documents first. And I first offered a low interest rate. When I noticed after a few days that investors were not biting, I increased it. That took a little time. All in all, I ended up with an interest rate of twelve percent – but I'm sure that I did better overall with it than if I'd turned to a bank. Fast, little bureaucracy, no unpleasant discussions at different banks – these were the decisive points, which then also proved to be true.

Were there contacts with the financiers, or do you know them?

I don't know the names of my backers, only their pseudonyms. But the backers can get in touch with a message on the platform. I've been asked about my natural trunk homes more than once – there have been no questions about credit or my finances. Many people liked what I was trying to do, and these people invested in it. When the loan is due for repayment, the amount is simply debited from the account, and I have no further contact with the lenders.

For whom is this form of financing suitable?

If you want to use the financing via "smava" for a business start-up, you also have to show a fixed income. So if you are in a permanent position and the start-up is on the side, "smava" comes into question. However, this solution is not suitable for financing a full-time start-up – self-employed persons must prove that they have been successfully operating as an entrepreneur for two years.

How to get a personal loan via the Internet?

Who looks around for the first time with "smava", should take time and read in all peace the answers to frequent questions as well as in the

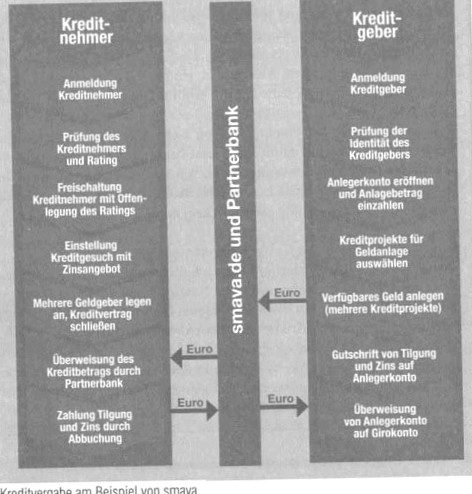

Browse existing loan projects. How the whole thing works then becomes relatively quickly clear. The following figure makes it easier to get started, "smava" earns from the business with personal loans in the form of a commission. Currently, two percent is deducted from the loan or credit amount as a disagio – i.e. a discount when the loan or credit is disbursed. Borrowers can find out the applicable rate on the website of "smava" and should add this item to the cost incurred by interest. Currently, the interest level is on average between seven and twelve percent. There is no additional expense, unlike loans from banks, because there are no account maintenance fees, costs for verification and other incidental expenses.

Verification of identity

When registering on the platform, it is sufficient to present a copy of an identity card. Only when you obtain a loan through "smava" is your identity verified using the Postident process. After completing a financing project, you go to a post office with your identification papers. The postal employee checks your identification documents, transfers the information to a coupon, and both you and the postal employee sign that the information on it is correct. The Postident procedure is mandatory for the loan agreement via "smava" to become effective.

Creditworthiness classes of the Schufa

With your consent, "smava" obtains information about your credit-worthiness from Schufa. smava" uses the Scoring value for special credit institutes. This is composed of data about your previous behavior in financial matters and statistical values. It Determines the classification in one of the credit rating classes from A to M, where A is the best.

The result represents the probability that the person in question will not be able to meet his or her payment obligations. For credit rating class B, there is currently a probability of 2.46 percent that debtors categorized accordingly will not meet their obligations. The values of the creditworthiness classes (as of 2009) can be found in the following table.

| Schufa credit rating | Percentage of population % | Default risk for the loan% |

| A | 20 | 1,38 |

| B | 20 | 2,46 |

| C | 10 | 3,56 |

| D | 10 | 4,41 |

| E | 10 | 5,57 |

| F | 10 | 7,16 |

| G | 10 | 10,72 |

| H | 5 | 15,02 |

| 1 | 2 | 20,95 |

| K | 1 | 22,26 |

| L | 1 | 27,01 |

| M | 1 | 42,40 |

For projects at "smava" at least credit rating class H is required.

Debt service capability

When registering on the platform, data about your income situation and your living costs are requested. Thus, "smava" determines another value, the so-called KDF indicator. KDF stands here for debt service capability. Anyone who wants to conclude a loan agreement via "smava1 must prove with two tax assessment notices and the corresponding annual financial statements that they have been self-employed for at least two years and have regular income. In addition, data on the period since the last income tax assessment is required.

Tip

Consider alimony payments

Many divorced women receive alimony payments. This income is included in the KDF indicator if a court judgment is available. So don't forget to include alimony and submit proof of it. Voluntary payments, on the other hand, are not taken into account, as these could be discontinued at any time.

The KDF indicator shows what proportion of your freely disposable net income is used for obligations arising from finance. Here, the KDF indicator is graded as follows:

– KDF indicator 1: 0 to 20 percent

– KDF indicator 2: 20 to 40 percent

– KDF indicator 3: 40 to 60 percent

– KDF indicator 4: 60 to 80 percent (activation at "smava" only up to 67 percent)

– KDF indicator 5: 80 to 100 percent (no activation to the marketplace)

An example shows more clearly how this indicator is calculated.

Determination of expenditure on financing

200 Euro for leasing installments

+ 200 euros for an existing bank loan + 100 euros for the "smava" loan = 500 euros expenditure on financing

Determination of monthly expenses

300 Euro current operating costs (annual average)

+ 1.700 euros private expenditure (annual average)

= 2.000 euros monthly expenditure

Determining net disposable income

2.800 Euro profit from self-employment (annual average) + 200 Euro other income (annual average)

– 2.000 Euro monthly expenditure (private and business)

= l.000 Euro net disposable income

The percentage is calculated with the following formula:

Percentage for KDF indicator = (Monthly expenses for financing/ Net disposable income) x 100

Percentage = (500 / 1.000) x 100 = 50 percent

KDF indicator = 3

No more than two thirds of the freely disposable net income may be used for monthly charges from financing – otherwise the activation at "smava" is not possible. The burden of the "smava" loan is included in the calculation; here is the only adjusting screw for you to influence the percentage and thus the KDF indicator. So, under certain circumstances, you can use the maximum amount of 25.000 euros and have to borrow less money, or you repay the amount over five years instead of three years.