Even if natural gas and nuclear power are classified as climate-friendly under the EU taxonomy, this is unlikely to change the perception of these energy sources among sustainability-minded investors, says Matthias Fawer of Vontobel. He does not expect a renaissance of nuclear power, as there is solid potential for cost reduction in solar and wind energy.

"The EU Commission's plans to classify natural gas and nuclear energy as climate-friendly energy sources under the EU taxonomy are unlikely to change the perception of mainstream investors who care about sustainable investment products, in our view", says Matthias Fawer, Analyst ESG& Impact Assessment at Vontobel. Nuclear power, he said, is generally interpreted by sustainability-focused investors as a disqualifier for their sustainable products, as are coal, oil and other fossil fuels, including natural gas. As a rule, threshold values of five to ten percent are set for investments. So far, Vontobel has not received any indications from its clients that this positioning could change significantly.

Two different values for taxonomy compliance

"Whatever the final outcome for the taxonomy rules: We expect that asset managers may report two different values for their taxonomy compliance – one with and one without nuclear and natural gas", says Fawer. This would ensure transparency for their customers, who in turn would be able to decide what they consider to be "green" plants. This is also important to avoid shaking confidence in the Sustainable Finance Disclosure Regulation (SFDR) as a whole.

The controversial proposal at the turn of the year also has a positive aspect: It opens the debate on how to shape the difficult and delicate transitional phase until renewable energies can cover the entire electricity demand.

"Against this backdrop, we will continue to invest in power utilities that demonstrate a responsible transition strategy. In our view, such a strategy involves channeling the bulk of capital expenditure (CAPEX) into new renewable energy capacity, while keeping conventional power plants – mainly gas and nuclear, as coal-fired power is the first form of energy to be wound down – in operation as a necessary reserve for individual regions for as long as necessary", says Fawer.

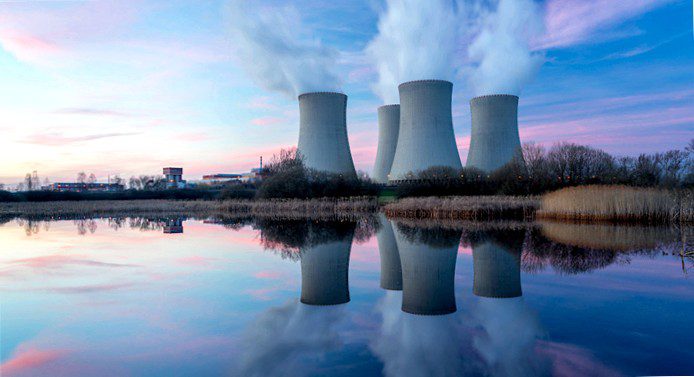

No need for new risky nuclear power projects

At Vontobel, we believe that the discussion should focus more on planning a sensible and safe wind-down phase for nuclear power plants than on investing in expensive and lengthy new projects. These would come too late anyway to bridge various current bottlenecks. Perhaps the only investments that made sense were some gas-fired power plant projects that would serve as emergency reserves and meet peak demand, possibly in combination with CO₂ capture, utilization, or storage.

"From an economic point of view, there is no doubt in our mind that there will not be a renaissance of nuclear power. The potential for cost reduction and scalability of solar and wind power is too solid – even taking into account battery and energy management improvements – and project implementation is much more rapid, so there is no need for new risky nuclear power projects", emphasizes the Vontobel expert.